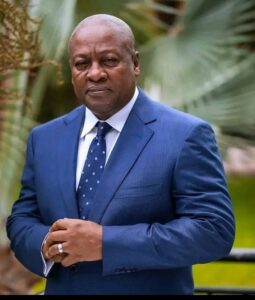

John Dramani Mahama Finally Scraps Electronic Levy and Betting Tax

In a landmark move, President John Dramani Mahama has officially scrapped the controversial Electronic Levy (E-Levy) and the Betting Tax, fulfilling one of his major campaign promises. This decision comes as a relief to millions of Ghanaians who have long protested against these taxes, arguing that they placed an unnecessary financial burden on individuals and businesses.https://chat.whatsapp.com/HPfqFbuSt7fA2MVV742k2V

A Controversial History

The E-Levy, introduced in 2022 under the previous administration, imposed a charge on electronic transactions, including mobile money transfers. It was met with widespread opposition from both the public and economic experts, who argued that it discouraged digital transactions and hurt small businesses. Despite several adjustments over the years, the tax remained unpopular.

Similarly, the Betting Tax, which levied a percentage of earnings from betting and gaming, faced resistance from the youth, many of whom rely on online betting as a source of income. Critics argued that the tax disproportionately affected unemployed and low-income individuals who used betting as an alternative means of financial support.

Why Mahama Took This Step

Mahama, who returned to power on a promise to ease the financial burden on Ghanaians, had consistently opposed these taxes, arguing that they were regressive and counterproductive. His administration believes that removing these levies will:

- Boost digital transactions by encouraging more people to use mobile money without fear of extra charges.

- Increase disposable income for Ghanaians, allowing them to spend more freely and support local businesses.

- Reduce the cost of doing business, particularly for small and medium enterprises that rely heavily on digital payments.

- Ease the financial strain on the youth, particularly those engaged in online gaming and betting.

Economic and Public Reactions

The announcement has been met with widespread praise, especially from business owners, financial analysts, and everyday citizens who see it as a step toward economic relief. Many believe that scrapping the E-Levy will reinvigorate Ghana’s digital economy, leading to increased mobile money usage and improved financial inclusion.

However, some economists warn that the government must find alternative ways to generate revenue without burdening the average Ghanaian. Questions remain about how Mahama’s administration will make up for the revenue previously generated by these taxes.

With these taxes now abolished, all eyes are on the Mahama government to see how it will implement alternative revenue measures without introducing new financial burdens. The administration has hinted at plans to improve tax collection efficiency, expand the tax base, and invest in productive sectors to drive economic growth.

For now, Ghanaians can breathe a sigh of relief as they enjoy financial transactions without the extra deductions that had long been a source of frustration. Whether this move will translate into long-term economic benefits remains to be seen, but for many, it is a step in the right direction.

What do you think about the removal of the E-Levy and Betting Tax? Will it have a positive impact on the economy? Share your thoughts in the comments.